How to Fill Out Form WH-347 (Without Getting Confused)

If you’re working on a government-funded construction job, you’ve probably heard of Form WH-347. Sounds official, right? Maybe even intimidating.

But don’t worry—we’re going to walk you through it in super simple steps.

Form WH-347 is just a weekly payroll form that tells the government who worked on the project, how much they got paid, and if everything was done legally.

Here’s what it looks like in plain English:

First Things First: What Is Form WH-347?

It’s a certified payroll report that you fill out every week when you have workers on a federal or public works job.

You’re basically saying:

"Here’s who worked, here’s what we paid them, and yes, we followed the rules."

What You’ll Need Before You Start:

Your employees’ names and job titles

Their hours worked each day

Their hourly pay rate and fringe benefits

👉 Not sure what counts as a fringe benefit? Check out this simple guide.

Your project’s name and location

The wage determination for the job

Now let’s break down each part of the form.

Top Section – Project Info

This is just the who, what, and where.

Contractor or Subcontractor: Your company name

Address: Your business address

Payroll Number: Start with 1 and go up each week

For Week Ending: The last day of the workweek

Project/Contract No.: Grab this from your contract

Project Name and Location: Easy—name and address of the job site

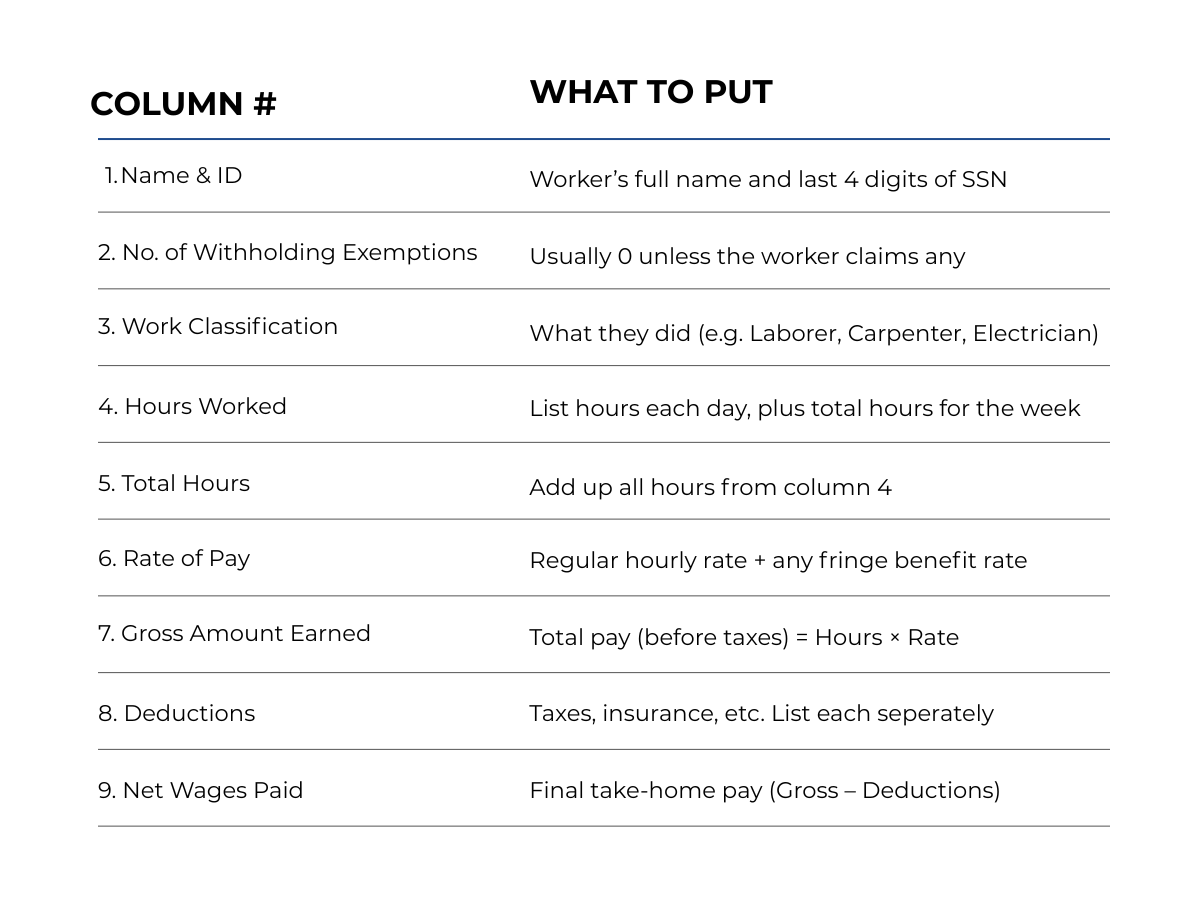

Column Breakdown (Lines 1–9)

Here’s the part most people stress about. It’s not that bad once you see what each column means:

Statement of Compliance (Page 2)

This is where you sign off and say:

Yes, we paid the correct wages

Yes, we followed the rules

No, we’re not cutting corners

You’ll include:

Your name and title

The date

Your signature

This is a legal document. Only sign if everything is correct.

Common Mistakes to Avoid

Wrong job classifications (e.g., calling a Laborer a Foreman)

Forgetting to add fringe benefits

Leaving out hours for part-time or temp workers

Not signing the Statement of Compliance

Want a Cheat Sheet?

Grab our free WH-347: Simple Cheat Sheet:

👉 Download our WH-347 Cheat Sheet

Final Tips

Use the same payroll number each week to stay organized

Save your forms for at least 3 years (in case of audits)

Use a digital system if you can—it makes it way easier

Need someone to double-check your first few forms?

Contact Davis Bacon Solutions, and we’ll help you get it right.